Incoterms 2022: A Crucial knowledge for Successful International Outsourcing

Navigating Risks, Ensuring Clarity, and Optimizing Trade: Incoterms Your Key to Seamless Global Sourcing

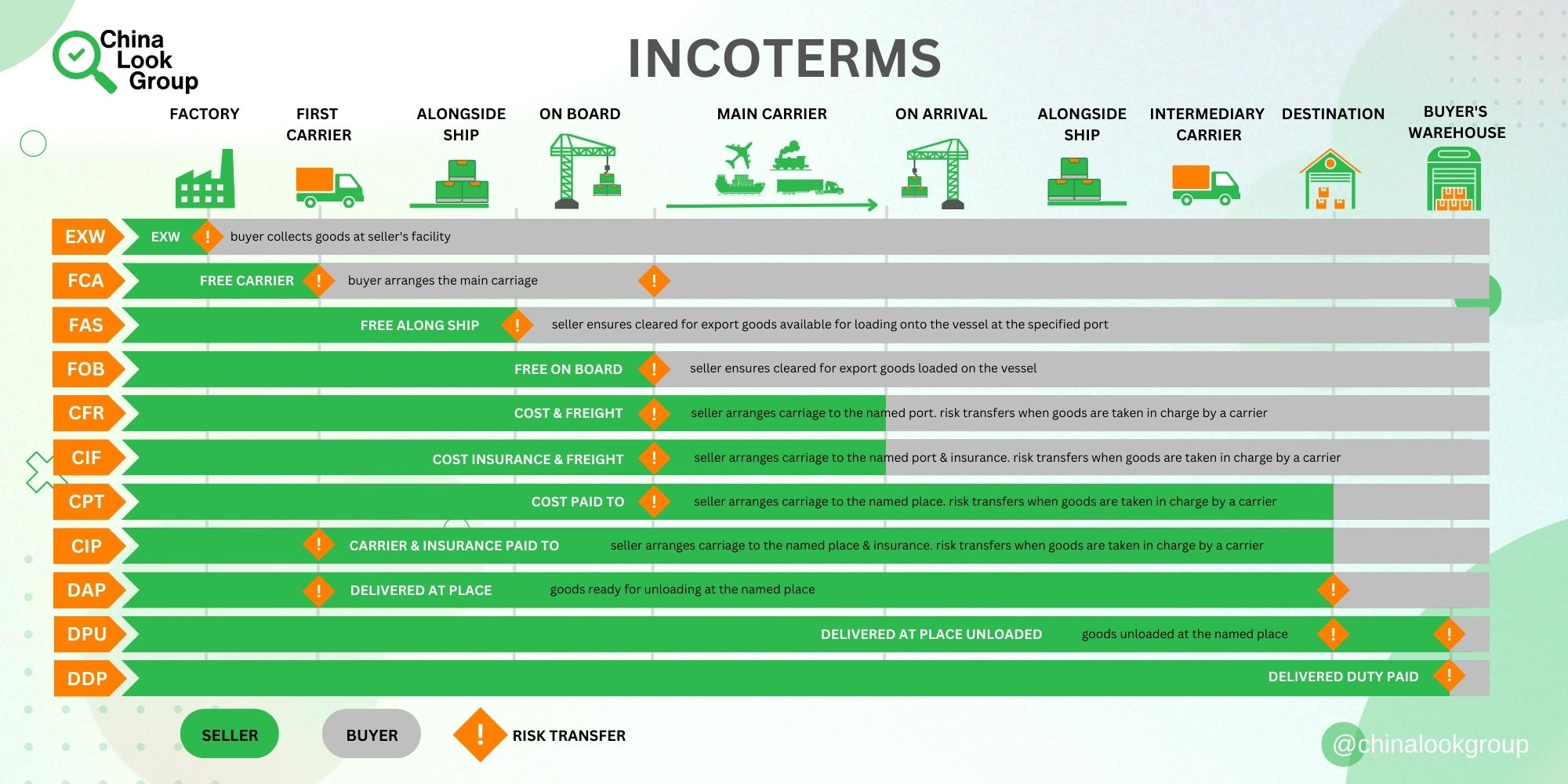

What is Incoterms 2022?

Incoterms are short for International Commercial Terms. Incoterms are the selling terms that the buyer and seller of goods both agree to during international transactions.

To put it simply, incoterms help both supplier and the buyer determine where and when the responsibility for the goods is transferred. Who is responsible for export and import, and who arranges logistics, both in the supplier’s country and in the buyer’s country, and generally outlines the risks and costs beard by the supplier and the buyer.

The first incoterms were first published in 1936 by the International Chamber of Commerce (ICC) and are continually updated over time to reflect the changing global business tendencies and environment. Currently, the latest incoterm version update was in 2022.

Since the terms and specified responsibilities of the incoterm of 2010 and 2022 differ you need to make sure that in all transactional documentation between buyer and supplier the agreed incoterm abbreviation and the year of this incomers update are mentioned.

Why do you need to know your Incoterms?

Understanding Incoterms is crucial for businesses engaged in international trade. As companies seek to reduce purchasing costs and explore sourcing options from low-cost regions like China, they enter into complex international trade relationships that are subject to regulations in each country involved. This is where Incoterms play a vital role.

Incoterms provide a standardized set of rules and terms that ensure clarity and transparency in import and export transactions. They establish the rights, obligations, and responsibilities of both the Chinese supplier and the foreign buyer at each stage of the transaction. By adhering to the appropriate Incoterm, businesses can navigate potential pitfalls and mitigate risks that may arise during international trade.

The use of Incoterms helps to create a common understanding between the seller and the buyer, reducing the chances of misunderstandings or disputes. They specify important details such as the point of delivery, the allocation of costs and risks, and the necessary documentation and procedures involved in the transaction.

What are the Types of Incoterms?

At the time of this publication, there are currently 11 Incoterms designed to outline the risks and costs assumed by Buyers and Suppliers in each trade agreement. They are broken into two subcategories: any type of transport and waterway transport.

There are seven rules of Incoterms for any mode of transport

There are four rules of Incoterms for sea and inland waterway transport

The 7 Rules for Any Mode of Transport

Group E

EXW – Ex Works – the Supplier is responsible for ensuring that the goods are ready for collection at their facility (e.g. factory, warehouse, production site, etc.,). The buyer handles the logistics, including arranging for transportation, paying for all duties and taxes, securing insurance coverage, and preparing all necessary documentation for export and import procedures.

To put it simply, the key point is that the seller’s responsibility ends once the goods are made available at their premises, and from that point onwards, all costs, risks, and obligations related to the transportation, duty payment, customs clearance, export, and import procedures of the goods, fall on the buyer.

Group F

FCA – Free Carrier – A very flexible rule that is suitable for all situations where the buyer arranges the main carriage.

The key to the FCA rule is to specify the delivery point in the contract of sale, which is where the Incoterms can be refined.

Under FCA, when the place of delivery is the seller’s premises, the seller is responsible for loading the goods onto a truck or other transport vehicle. This is one of the key differences between Ex Works (EXW) and FCA when it comes to loading goods. Often, exporters default to EXW, but if they’re loading the goods, the correct term should be FCA.

When the place of delivery is somewhere else, delivery is completed when the goods, which have been loaded on the seller’s means of transportation, arrive at the named location and are ready to be unloaded by the carrier or other representative identified by the buyer.

In either case, once the goods have been delivered by the seller, the buyer is responsible for all the risk of loss or damage to the goods.

Group C

CPT – Carriage Paid to – The seller is responsible for arranging carriage to the named place (e.g. port in buyer’s country), but not for insuring the goods to the named place. However delivery of the goods takes place, and risk transfers from seller to buyer, at the point where the goods are taken in charge by a carrier.

Things to watch out for Terminal Handling Charges (THC) are charges made by the terminal operator. These charges may or may not be included by the carrier in their freight rates – the buyer should enquire whether the CPT price includes THC, to avoid surprises.

The buyer may wish to arrange insurance cover for the main carriage, starting from the point where the goods are taken in charge by the carrier – this will not be the place referred to in the Incoterms rule but will be specified elsewhere within the commercial agreement

Note: CPT Carriage Paid to is similar to CFR – Cost and Freight, the main difference is that CPT is for any method of transport, and the CFR is for Sea and Inland Waterway Transport.

CIP – Carriage and Insurance Paid To – The seller is responsible for arranging carriage to the named place, and also for insuring the goods. As with CPT, delivery of the goods takes place, and risk transfers from seller to buyer, at the point where the goods are taken in charge by a carrier.

Things to watch out for Terminal Handling Charges (THC) are charges made by the terminal operator. These charges may or may not be included by the carrier in their freight rates – the buyer should enquire whether the CPT price includes THC, to avoid surprises.

The level of insurance cover that the seller is obliged to obtain – there are differences here between Incoterms 2010 and Incoterms 2020. If necessary, different levels of cover may be included in the commercial agreement.

Note: CIP Carriage and Insurance Paid is similar to CIF – Cost Insurance and Freight, the main difference is that CIP is for any method of transport, and the CIF is for Sea and Inland Waterway Transport.

Group D

DAP – Delivered at Place – The seller is responsible for arranging carriage and for delivering the goods, ready for unloading from the arriving means of transport, at the named place. (An important difference from Delivered at Place Unloaded DPU.)

Risk transfers from seller to buyer when the goods are available for unloading; so unloading is at the buyer’s risk.

The buyer is responsible for import clearance and any applicable local taxes or import duties.

DPU – Delivered at Place Unloaded –The seller is responsible for arranging carriage and for delivering the goods, unloaded from the arriving means of transport, at the named place. Risk transfers from seller to buyer when the goods have been unloaded. This is the only rule that requires the seller to unload the goods to complete delivery.

The buyer is responsible for import clearance and any applicable local taxes or import duties.

A useful rule, well suited to container operations where the seller bears responsibility for the main carriage.

Things to watch out for The place must be specified precisely, as many transport hubs are very large

DDP – Delivered Duty Paid – The seller is responsible for arranging carriage and delivering the goods at the named place, cleared for import, and all applicable taxes and duties paid (e.g. VAT, GST). Risk transfers from seller to buyer when the goods are made available to the buyer, ready for unloading from the arriving means of transport

This rule places the maximum obligation on the seller and is the only rule that requires the seller to take responsibility for import clearance and payment of taxes and/or import duty.

Things to watch out for Import clearance and payment of taxes and/or import duties can be highly problematical for the seller, since in some countries, these procedures are complex and bureaucratic, and so best left to the buyer who has local knowledge.

The 4 Rules for Sea and Inland Waterway Transport

Group F

FAS – Free Alongside Ship – Under FAS, the seller is responsible for delivering the goods alongside the vessel at the named port of shipment. And the responsibility for export customs clearance generally falls on the seller.

The seller must ensure that the goods are cleared for export and make them available for loading onto the vessel at the specified port. This includes arranging and covering the costs associated with export custom clearance, export duties, taxes, and other export-related documentation.

Once the goods are alongside the vessel at a named port, at this point risk transfers to the buyer. The buyer is responsible for loading the goods on the vessel and all costs thereafter.

In practice, FAS should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargo or non-containerized goods.

For containerized goods, consider “Free Carrier FCA” instead.

FOB – Free on Board – Under FOB, the seller is responsible for loading the goods on the vessel at the named port of shipment. And the responsibility for export customs clearance falls on the seller.

The seller must ensure that the goods are loaded onto the vessel at the specified port. This includes arranging the loading and covering the costs associated with export custom clearance, export duties, taxes, and other export-related documentation.

Once the goods have been loaded on board, risk transfers to the buyer, who bears all costs thereafter.

Group C

CFR – Cost and Freight – Seller arranges and pays for transport to named port (e.g. port in buyer’s country). The seller delivers goods, cleared for export, loaded on board the vessel.

However risk transfers from seller to buyer once the goods have been loaded on board, i.e. before the main carriage takes place.

Note: Seller is not responsible for insuring the goods for the main carriage. (See CIF for insurance included incoterm )

In practice, it should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargo or non-containerized goods.

For containerized goods, consider ‘Carriage Paid To CPT’ instead.

CIF – Cost Insurance and Freight – Seller arranges and pays for transport to named port (e.g. port in buyer’s country). The seller delivers goods, cleared for export, loaded on board the vessel.

However risk transfers from seller to buyer once the goods have been loaded on board, i.e. before the main carriage takes place.

The seller also arranges and pays for insurance for the goods for carriage to the named port.

In practice, it should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargo or non-containerized goods.

For containerized goods, consider ‘Carriage and Insurance Paid CIP’ instead.

Overall, when doing business with China, the most commonly used incoterms are EXW, FOB, and DDP. However, EXW is very often confused with FCA.

In conclusion, understanding Incoterms is vital for businesses engaged in international trade, particularly when outsourcing and sourcing products from regions like China. Incoterms provide a standardized set of rules and terms that ensure clarity, transparency, and mutual understanding between the buyer and supplier throughout the import and export process. By reviewing quotes from suppliers and considering key elements such as agreement compliance, pricing and terms, delivery and timeline, and terms and conditions, businesses can effectively manage risks, avoid misunderstandings, and navigate the complexities of international trade. With the right knowledge of Incoterms, businesses can optimize their outsourcing strategies and establish successful partnerships with suppliers worldwide.

Thank you for sticking with us till the end. We encourage you to take bold but smartly calculated actions in your China business. Keep learning constantly and achieve new business heights every day!

Check out our related to this topic article on Medium