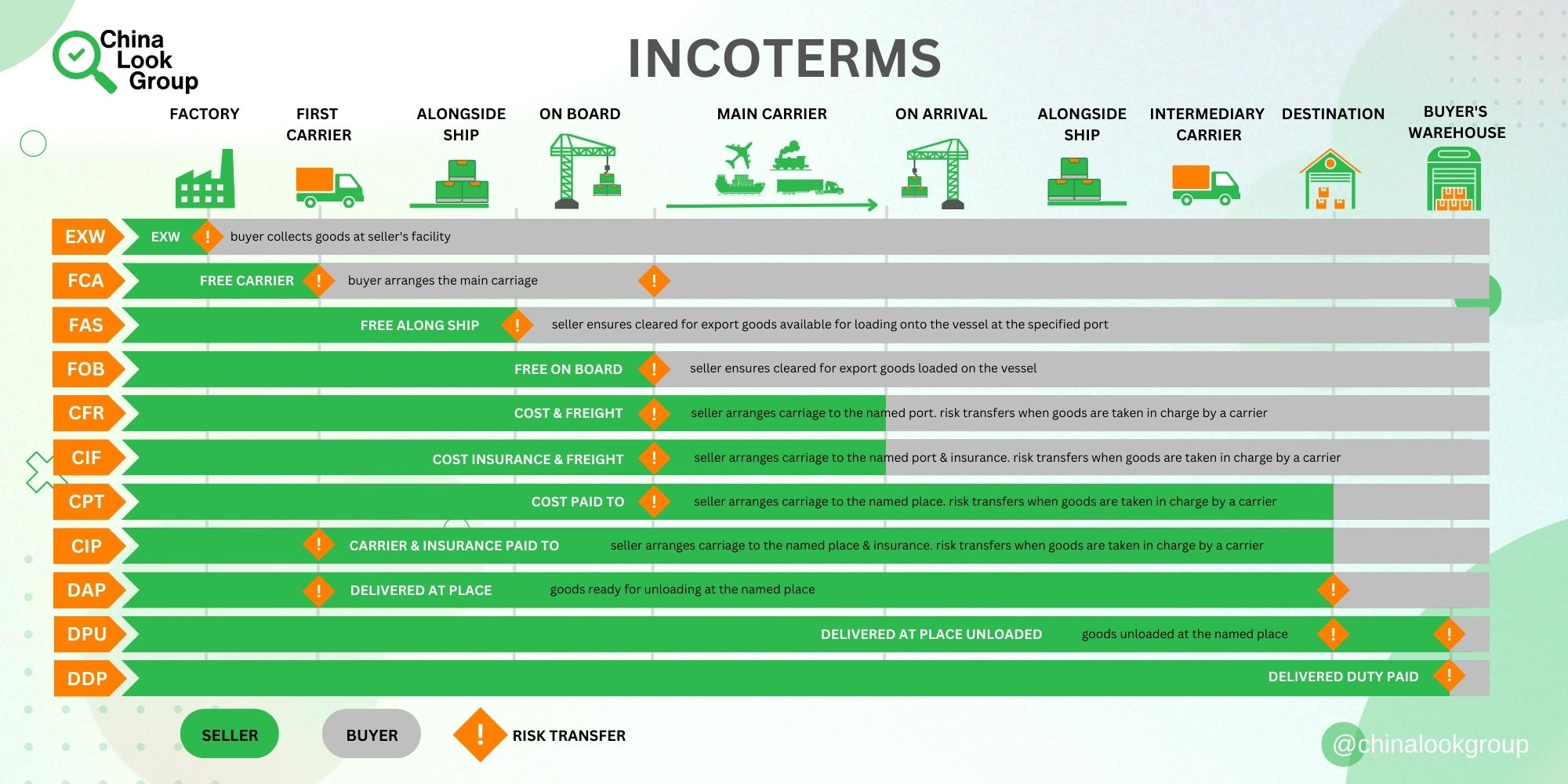

3 MUST KNOW INCOTERMS for China Exports

In our previous article, we delved into the world of incoterms, exploring the latest version for 2022 and providing a detailed breakdown of the associated responsibilities both from buyers’ and sellers’ perspectives.

We highly recommend reading our previous article for a comprehensive understanding of Incoterms.

However, in this article, we will focus on 3 commonly used incoterms when sourcing products from China.

First is, of course, Ex Works.

EXW – is when the Supplier is responsible for ensuring that the goods are ready for collection at their facility (e.g. factory, warehouse, production site, etc.,). The buyer handles the logistics, including arranging for transportation, paying for all duties and taxes, securing insurance coverage, and preparing all necessary documentation for export and import procedures.

Sometimes exporters confuse EXW and FCA incoterms. Under FCA, when the place of delivery is the seller’s premises, the seller is responsible for loading the goods onto a truck or other transport vehicle. This is one of the key differences between Ex Works (EXW) and FCA when it comes to loading goods. Often, exporters default to EXW, but if they’re loading the goods, the correct term should be FCA.

Overall EXW is the most basic and least helpful option in incoterms from the buyer’s perspective. Under EXW export terms, the supplier is only responsible to make the product available for pickup at their location, usually their factory or warehouse. After that, you’re on your own to figure out how to get it to your country. In other words, you have to pay for the shipping and deal with all the risks involved. You’ll also have to handle customs procedures and any associated costs, if applicable. The advantage of this method is that the supplier won’t make extra money by charging double shipping fees. Also, since the logistics and other associated fees will be handled by the third party company, the whole cost formation of your order will be very transparent for you, hence under your total control.

The second most commonly used incoterm FOB – Free on Board.

Under FOB, the seller is responsible for loading the goods on the vessel at the named port of shipment. And the responsibility for export customs clearance falls on the seller.

The seller must ensure that the goods are loaded onto the vessel at the specified port. This includes arranging the loading and covering the costs associated with export custom clearance, export duties, taxes, and other export-related documentation.

Once the goods have been loaded on board, risk transfers to the buyer, who bears all costs thereafter.

Be careful though, If your order size is less than a full container load (LCL), it will need to be combined with other cargo at the port, which typically requires an additional fee. You need to clarify beforehand with your supplier who will be handling this fee, because some suppliers may not include this cost when offering free onboard shipping.

The third most used incoterm when exporting goods from China is DDP – Delivered Duty Paid.

Under DDP incoterm the seller is responsible for arranging carriage and delivering the goods at the named place, cleared for import, and all applicable taxes and duties paid (e.g. VAT, GST).

Risk transfers from seller to buyer when the goods are made available to the buyer, ready for unloading from the arriving means of transport

This rule places the maximum obligation on the seller and is the only rule that requires the seller to take responsibility for import clearance and payment of taxes and/or import duty.

Things to watch out for Import clearance and payment of taxes and/or import duties can be highly problematical for the seller, since in some countries, these procedures are complex and bureaucratic, and so best left to the buyer who has local knowledge.

In conclusion, understanding the most commonly used incoterms when working with China is crucial for successful international outsourcing.

By familiarizing yourself with Ex Works (EXW), Free on Board (FOB), and Delivered Duty Paid (DDP), you can navigate the complexities of logistics, costs, and responsibilities, ensuring smoother transactions and greater control over your import-export operations.

Thank you for sticking with us till the end.

We encourage you to take bold but smartly calculated actions in your China business.

Keep learning constantly and achieve new business heights every day!